Form 941 Address 2024. If you are filing form 941 for the 2024 tax year via paper filing, the appropriate mailing address will depend on. Page last reviewed or updated:

Make sure to attach a generated payment voucher with your payment amount to the correct mailing address. When submitting the irs 941 quarterly report as an employer, the following data should be.

If You Choose To File By Mail, Make Sure That You Mail A Paper Copy Of Form 941 To The Correct Mailing Address.

( for a copy of a form, instruction, or publication) address to mail form to irs:

Page Last Reviewed Or Updated:

Go to tools > check for updates to download the latest program update.

Form 941 Address 2024 Images References :

Source: davidashawnee.pages.dev

Source: davidashawnee.pages.dev

Form 941 For 2024 Pdf Download Anjela Orelie, When submitting the irs 941 quarterly report as an employer, the following data should be. ( for a copy of a form, instruction, or publication) address to mail form to irs:

Source: albertinawalyce.pages.dev

Source: albertinawalyce.pages.dev

941 Forms 2024 Neysa Adrienne, Learn how to fill out form 941 by following the steps below. Where to mail 941 form for 2024 tax year?

Source: www.941reporting.com

Source: www.941reporting.com

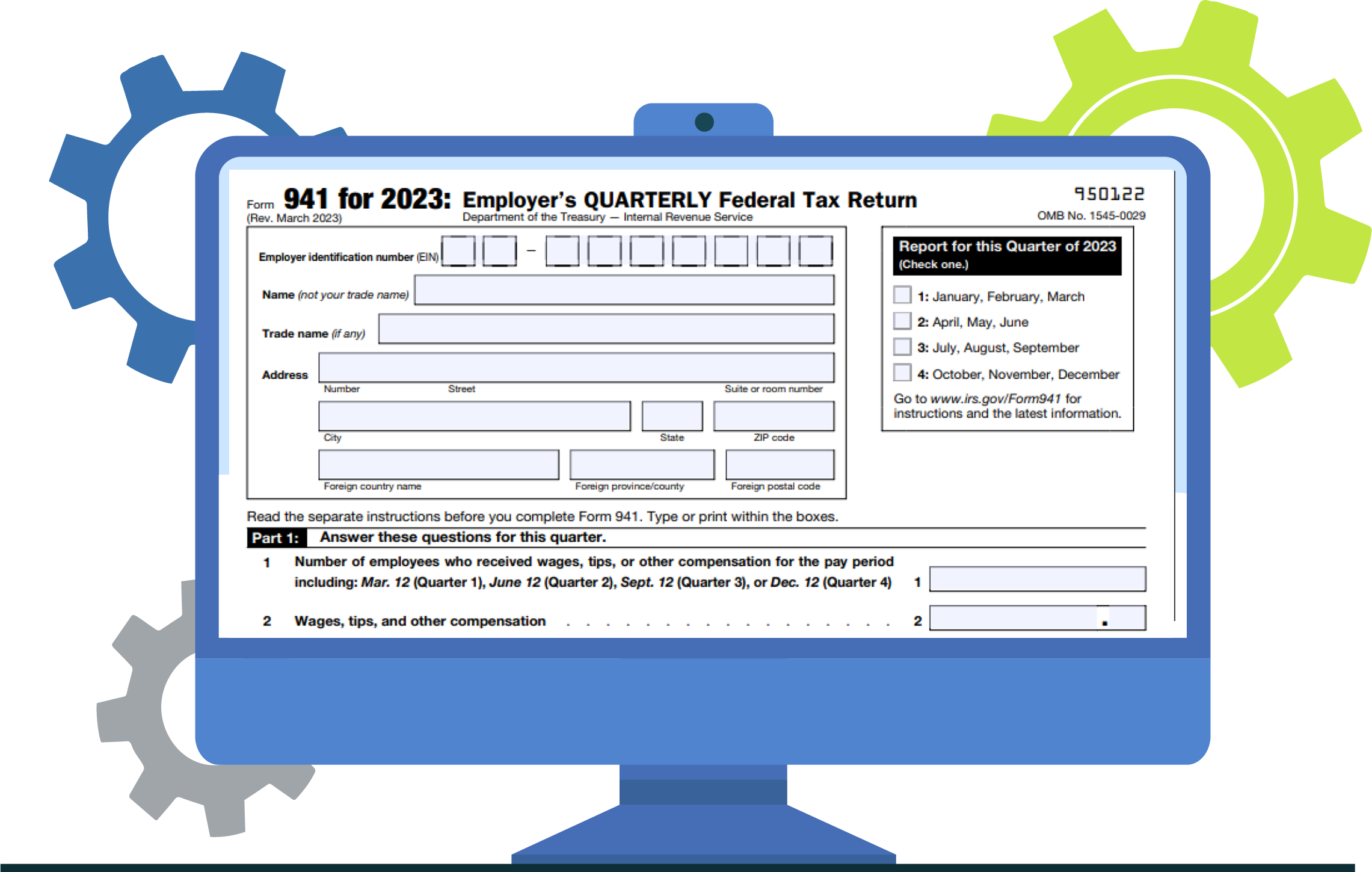

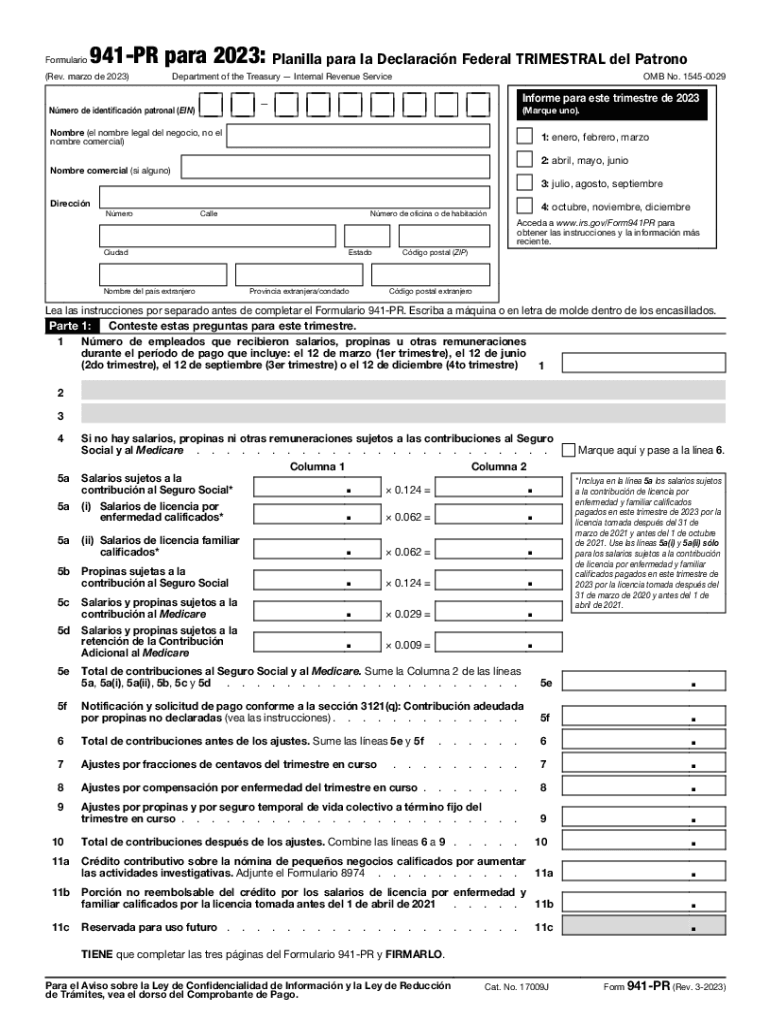

Form 941 Reporting Online for 2024 EFile 941 Quarterly, Where to mail 941 form for 2024 tax year? Form 941 for the 2024 tax year is the employer’s quarterly federal tax return that employers use to report income taxes, social security tax, and medicare taxes withheld.

Source: livviewolga.pages.dev

Source: livviewolga.pages.dev

Schedule B 941 For 2024 Pansy Beatrice, Find mailing addresses by state and date for form 941. Know how to file 941 online for 2024 & 2023.

Source: codeeqloraine.pages.dev

Source: codeeqloraine.pages.dev

941 For 2024 Employers Quarterly Andra Blanche, Find mailing addresses by state and date for form 941. Most businesses must report and file tax returns quarterly using the irs form 941.

Source: auriliaznydia.pages.dev

Source: auriliaznydia.pages.dev

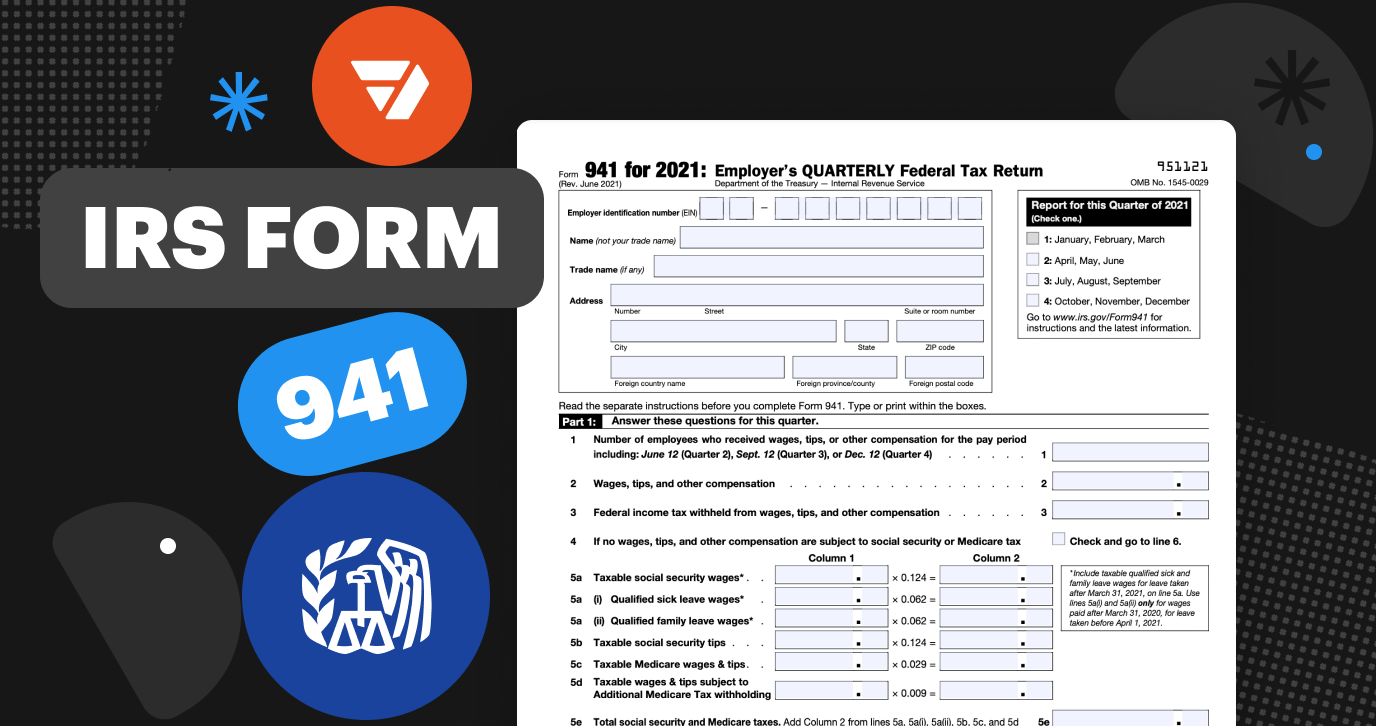

2024 Form 940 Schedule A Instructions porte carte, If you need to use. Irs form 941, commonly known as the employer’s quarterly federal tax return, is used by businesses to report the income taxes, payroll taxes, social security,.

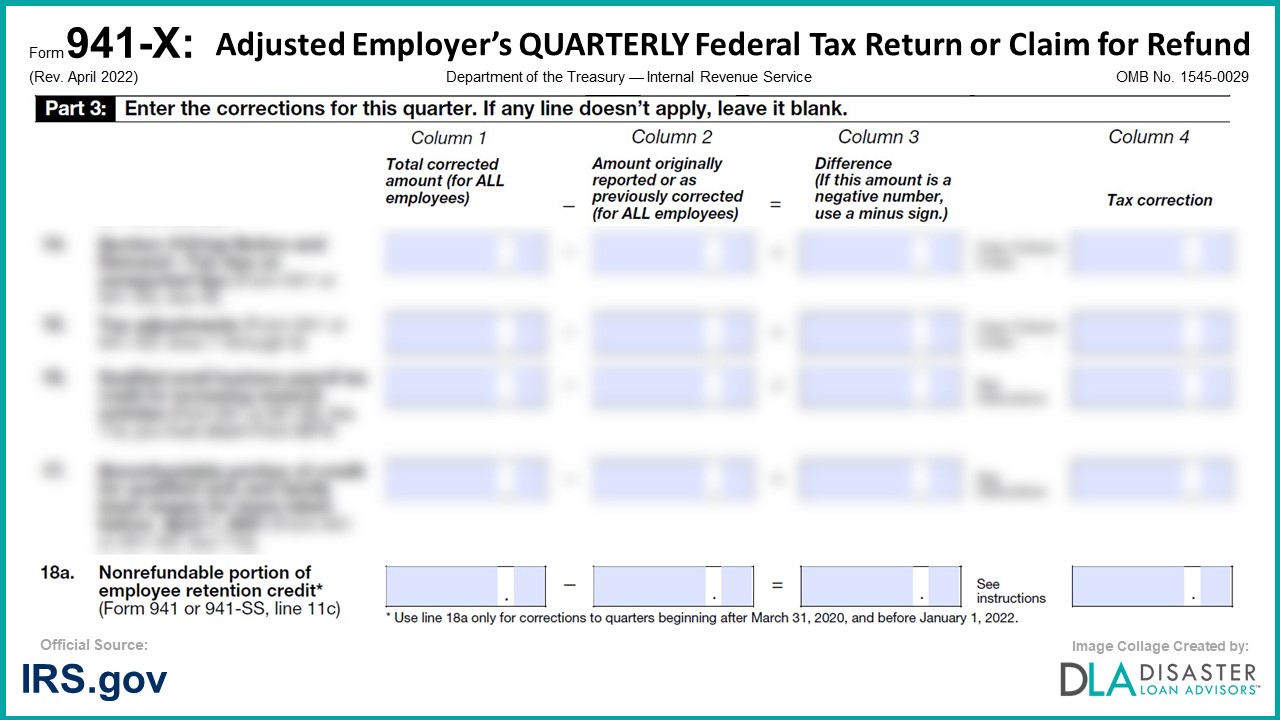

Source: www.disasterloanadvisors.com

Source: www.disasterloanadvisors.com

941X 18a. Nonrefundable Portion of Employee Retention Credit, Form, Know how to fill out form 941 with irs form 941 instructions for 2024. Form 941 for the 2024 tax year is the employer’s quarterly federal tax return that employers use to report income taxes, social security tax, and medicare taxes withheld.

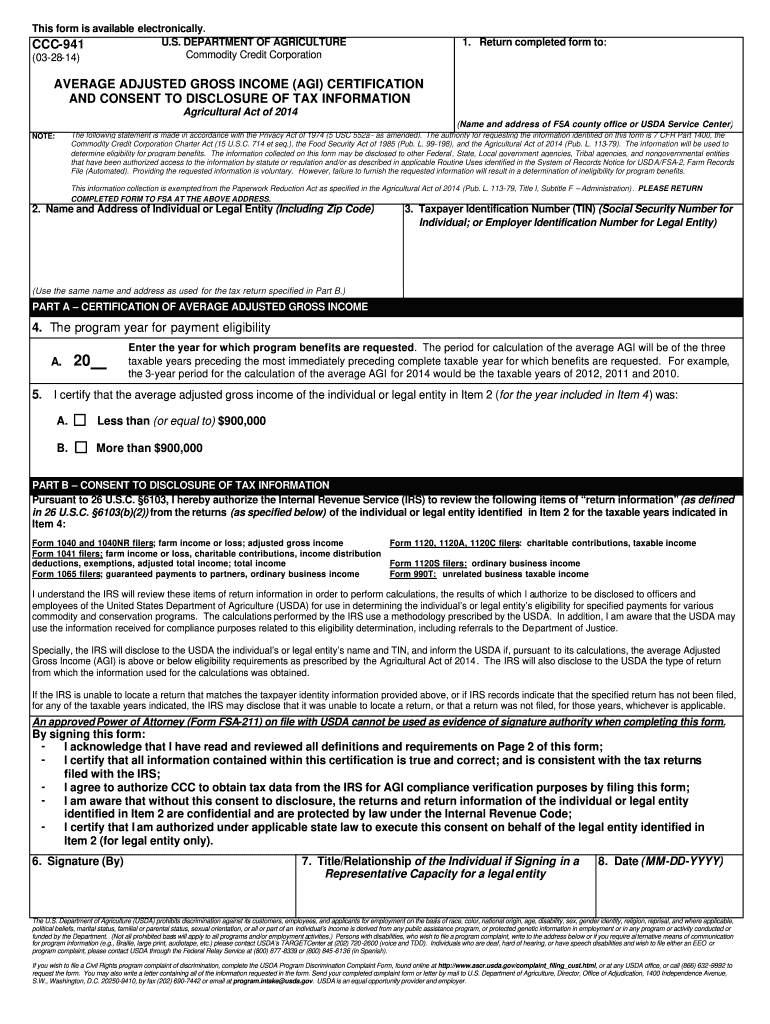

Source: www.signnow.com

Source: www.signnow.com

941 for 20232024 Form Fill Out and Sign Printable PDF Template, With these 941 filing instructions, you can complete and file your returns with the irs. Learn how to fill out form 941 by following the steps below.

Source: odettawdorree.pages.dev

Source: odettawdorree.pages.dev

Irs Filing Opening Date 2024 Aline Beitris, This guide provides the basics of the 941 form, instructions to help you fill it out,. It allows you to report employee.

Source: www.printableform.net

Source: www.printableform.net

How Do I Claim Employee Retention Credit On Form 941 Printable Form 2024, There are a few changes to form 941 that employers should be aware of before filing form 941. This guide provides the basics of the 941 form, instructions to help you fill it out,.

Irs Form 941, Commonly Known As The Employer’s Quarterly Federal Tax Return, Is Used By Businesses To Report The Income Taxes, Payroll Taxes, Social Security,.

Go to tools > check for updates to download the latest program update.

The Irs Form 941, Employer’s Quarterly Federal Tax Return, Used By Businesses To Report Information About Taxes Withheld Such As Federal Income, Fica.

There are a few changes to form 941 that employers should be aware of before filing form 941.